hotel tax calculator alberta

While Alberta does not have a provincial sales tax the federal 5 Goods and Services Tax GST still applies. Calculation of Alberta tax.

Sales Taxes In The United States Wikipedia

The tax rates in Alberta range from 10 to 15 of income and the combined federal and provincial tax rate is between 25 and 48.

. T his is a complete and simple to use Canadian sales tax calculator. For an employee. Provincial Room Tax In BC.

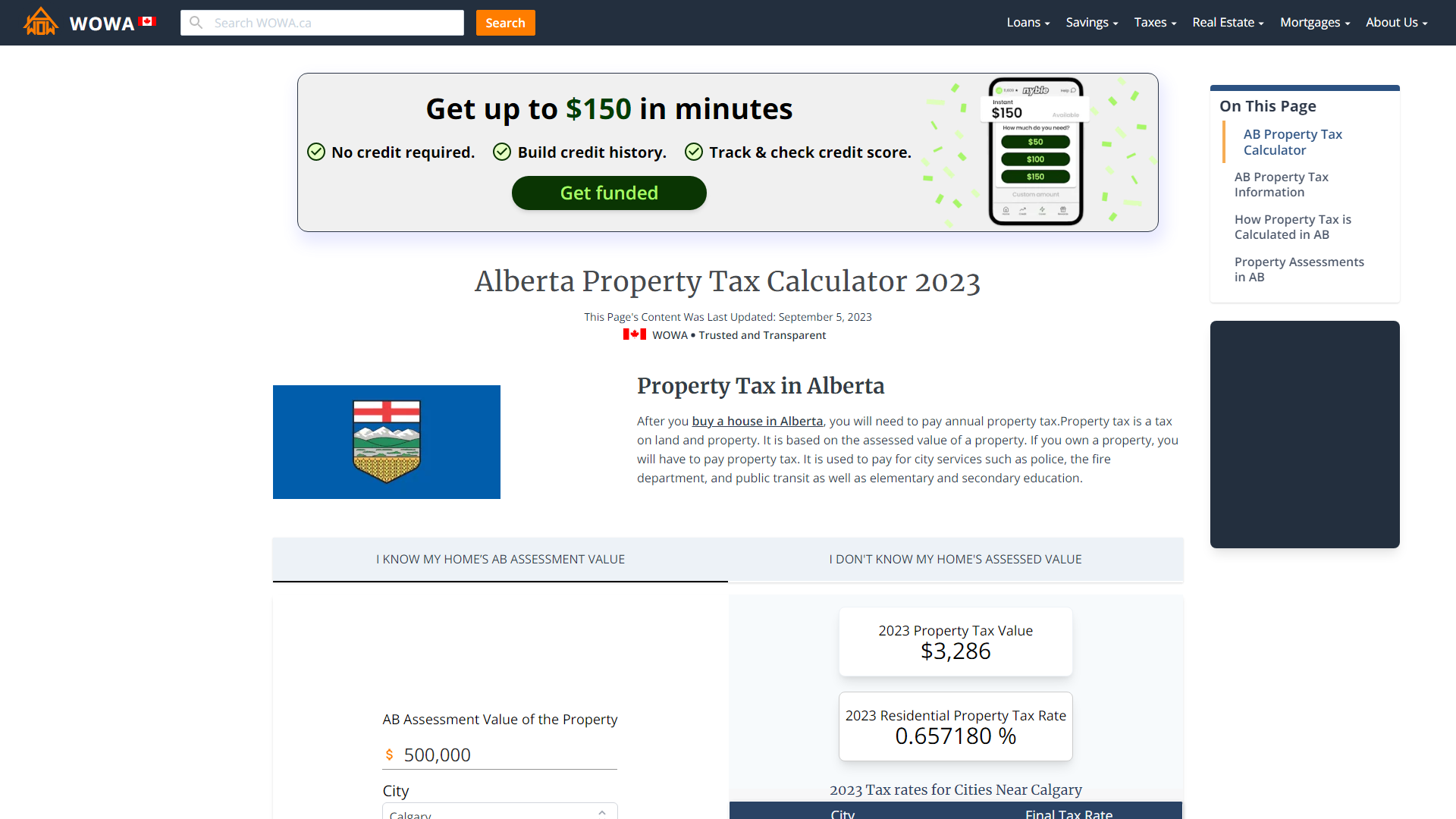

Over 131220 up to 157464. Hotels in Alberta levy an additional Destination Marketing Fee DMF up to 3 on top of the 4 MRDT. How is hotel tax calculated.

The tourism tax rate in Alberta is 4 and is called Tourism Levy tax. For 2022 the non-refundable basic personal amount in Alberta is 19369. Tax rates Less than 19369 0.

Annual Tax Calculator 2022. In reality with tax deductions it is likely to be even lower. To get the hotel tax rate a percentage divide the tax per night by the cost of the room before taxes.

For sales tax please visit our Alberta Sales Tax Rates. The Alberta Annual Tax Calculator is updated for the 202223 tax year. Aside from GST there is also a 4 tax on lodging and 4 tax on hotel room fees.

That means that your net pay will be 36398 per year or 3033 per month. Your average tax rate is. Over 157464 up to 209952.

The GST is expected to bring 408 billion in tax revenue during the 2019 fiscal. From 209952 to 314928. This works out to 17912 which is much lower than the 26000 one might assume.

Tabacco cigar and fuel also have. Alberta does not have a provincial room tax. How do tax brackets work.

Type of supply learn about what. The rate you will charge depends on different factors see. Multiply the answer by 100 to get the rate.

Alberta tax bracket Alberta tax rate. The provincial tax on hotel rooms is 8. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for.

ALBERTA No legislation used. Authorized by hotel associations on a city-by-city branded hotel group basis Calgary 3 Edmonton. Debit interest rates apply to programs under the Alberta Corporate Tax Act Fuel Tax Act Tobacco Tax Act and Tourism Levy Act as well as the Health Cost Recovery program.

The following explanation simplifies the calculation of the tax by displaying only the final result of the Net Income. The DMF is voluntary - hotels remove it from your bill when asked. Albertas marginal tax rate increases as your.

Alberta tax bracketAlberta. You can calculate your Annual take home pay based of your Annual gross. Between 2000 and march 31 st 2005 it was called hotel room tax and the rate was 5.

The Alberta Income Tax Salary Calculator is updated 202223 tax year. If you make 52000 a year living in the region of Alberta Canada you will be taxed 15602. Its different from a.

Municipal And Regional District Tax MRDT -This tax provides funding for. This can be useful either as merchant or. It will help you figure out taxes broken down by GSTHSTPST and by province.

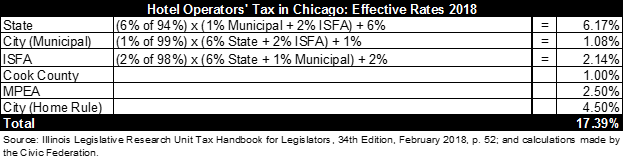

The following table provides the GST and HST provincial rates since July 1 2010. Over 209952 up to 314928. State legislated State Hotel Tax Bill 170 Hospitality.

For more information about the items and services that are exempt from Good.

Sales Taxes In The United States Wikipedia

How To Calculate Canadian Sales Tax Gst Hst Pst Qst 2020 Sage Advice Canada English

:max_bytes(150000):strip_icc()/494331203-56a82eec5f9b58b7d0f15dd3.jpg)

Gst Hst Information For Canadian Businesses

Calculating Machine Stock Photos Royalty Free Calculating Machine Images Depositphotos

Airbnb Occupancy Rates In Canada Best Cities For Investment In 2022 Airbtics Airbnb Analytics

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

Canadian Restaurant Tax Guide Quickbooks Canada

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

Town Of Canmore Property Assessments

2022 Canada Income Tax Calculator Turbotax Canada

Alberta Property Tax Rates Calculator Wowa Ca

Lodging Taxes Add To Your Vacation S Overall Cost Don T Mess With Taxes

Property Tax Calculator Property Tax Guide Rethority

What Inflation Will Do To Your 2022 Taxes Wsj

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

Hidden Gem The Canadian Marriott With A Nordic Spa That Stands In The Shadow Of Banff The Points Guy